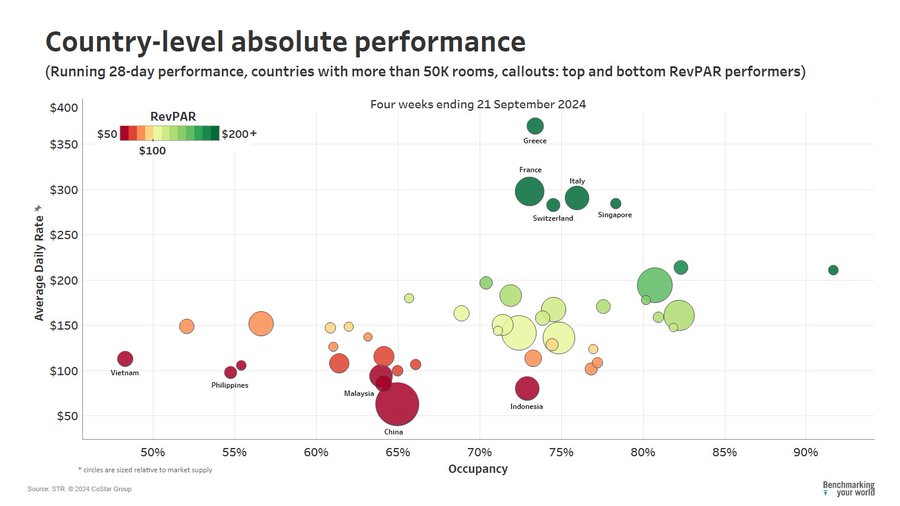

The hospitality sector has shown remarkable resilience and adaptability in recent times, with several markets experiencing notable growth in Revenue Per Available Room (RevPAR). According to the latest data, regions such as Northern Sumatra, Mexico City, the Red Sea Resorts, Rio de Janeiro, and the Turkish Riviera have emerged as standout performers. However, challenges persist in China, highlighting the diverse dynamics at play in the global hospitality landscape.

Understanding RevPAR and Its Significance

RevPAR, or Revenue Per Available Room, is a key performance metric in the hospitality industry. It is calculated by multiplying a hotel’s average daily room rate (ADR) by its occupancy rate. This metric provides a comprehensive view of a hotel’s ability to fill its rooms at an average rate, making it a crucial indicator of financial health and operational efficiency.

Regional Highlights: Northern Sumatra and Mexico City

Northern Sumatra has seen a steady increase in tourism, driven by its rich cultural heritage and natural beauty. The region’s hospitality sector has capitalized on this influx, with hotels reporting higher occupancy rates and increased ADR. Similarly, Mexico City has become a hotspot for both leisure and business travelers, contributing to its robust RevPAR growth.

The Red Sea Resorts: A Jewel in the Middle East

The Red Sea Resorts have long been a favorite among tourists seeking sun, sea, and luxury. Recent investments in infrastructure and marketing have paid off, with the region experiencing a significant boost in RevPAR. The introduction of new luxury resorts and the enhancement of existing properties have attracted a diverse range of visitors, from honeymooners to adventure seekers.

Rio de Janeiro: A Carnival of Opportunities

Rio de Janeiro continues to be a magnet for tourists, thanks to its vibrant culture, stunning beaches, and world-renowned events like the Carnival. The city’s hospitality sector has leveraged these attractions to drive RevPAR growth. Hotels in Rio have reported higher occupancy rates, particularly during peak tourist seasons, contributing to the overall positive trend.

The Turkish Riviera: A Blend of History and Luxury

The Turkish Riviera, with its blend of historical sites and luxurious resorts, has seen a surge in tourist arrivals. This increase has translated into higher RevPAR for the region’s hospitality sector. The Turkish government’s efforts to promote tourism, coupled with the region’s natural and cultural attractions, have made it a preferred destination for travelers from around the world.

Challenges in China: A Complex Landscape

While several markets have shown positive trends, China continues to face challenges in its hospitality sector. Factors such as geopolitical tensions, economic uncertainties, and changing travel patterns have impacted RevPAR growth. However, industry experts remain optimistic about the long-term potential of the Chinese market, given its vast domestic tourism base and ongoing investments in infrastructure.

Global Trends and Future Outlook

The global hospitality sector is witnessing several key trends that are shaping its future. One notable trend is the rise in average daily rates (ADR) across most key markets. For instance, India’s hospitality sector saw a 4.8% increase in RevPAR in Q2 2024, driven by rising ADRs despite lower occupancy rates due to summer vacations. The sector anticipates a busy upcoming quarter, fueled by corporate travel and social events, as highlighted in a report by JLL.

Another significant trend is the growing interest in greenfield developments and operating assets in the hospitality sector. Investors are increasingly looking at branded hotel openings in tier 2 and 3 cities, with 50 hotels comprising 3,755 keys opening in Q2 2024 alone. This trend indicates a promising outlook for the hospitality sector, driven by anticipated increases in corporate travel and social events.

Impact of Geopolitical Events and Government Policies

Geopolitical events and government policies play a crucial role in shaping the hospitality sector. For example, the ongoing general elections in India have had a minor impact on corporate and MICE (Meetings, Incentives, Conferences, and Exhibitions) business. However, the overall sentiment remains positive, with industry sources estimating a 30 to 40% increase in summer travel compared to last year.

Similarly, visa exemptions and other government policies have a significant impact on inbound tourism. The Trip.com Group has highlighted the positive travel trends during the Golden Week 2024, with Chinese tourists exploring beyond capitals and opting for lesser-known destinations. This shift in travel patterns is likely to benefit the hospitality sector in these emerging destinations.

Conclusion: A Promising Future for the Hospitality Sector

For more insights into the latest trends and developments in the hospitality sector, read our detailed analysis on the best hotels for autumn staycations and the growing trend of agritourism and farm diversification.

Ready to Transform Your Hotel Experience? Schedule a free demo today

Explore Textify’s AI membership

Explore latest trends with NewsGenie